Getting The Mortgage Broker To Work

Wiki Article

Get This Report about Mortgage Broker In Scarborough

Table of ContentsFacts About Mortgage Broker In Scarborough RevealedNot known Facts About Mortgage Broker ScarboroughThe smart Trick of Scarborough Mortgage Broker That Nobody is Talking AboutWhat Does Scarborough Mortgage Broker Do?The 2-Minute Rule for Mortgage Broker Near MeRumored Buzz on Scarborough Mortgage BrokerMortgage Broker Things To Know Before You Get ThisRumored Buzz on Mortgage Broker Scarborough

You're a little anxious when you first come to the home loan broker's office. You require a mortgage Yet what you actually want is the residence. The finance is simply getting in your means. Maybe you have actually already located your dream residence, or perhaps you're being available in with a general concept of the sort of home you're interested in In either case, you need suggestions.The home mortgage broker's work is to understand what you're trying to accomplish, work out whether you are prepared to jump in currently and also after that match a lender to that. Before speaking concerning lending institutions, they need to gather all the info from you that a financial institution will certainly require.

The Best Strategy To Use For Mortgage Broker

A major modification to the industry happening this year is that Home loan Brokers will have to follow "Benefits Task" which indicates that legitimately they need to place the client first. Interestingly, the financial institutions do not have to abide by this brand-new policy which will certainly benefit those customers utilizing a Home loan Broker even more.It's a home mortgage broker's work to assist get you all set. It might be that your cost savings aren't quite yet where they must be, or it might be that your income is a little bit suspicious or you have actually been freelance and the financial institutions need even more time to examine your situation. If you're not yet all set, a mortgage broker exists to outfit you with the understanding and guidance on just how to enhance your position for a funding.

9 Simple Techniques For Mortgage Broker In Scarborough

Mortgage brokers are writers. Their work is to paint you in the light that offers you the greatest chance of being authorized for a loan. The loan provider has actually accepted your lending.The home is your own. Written in partnership with Madeleine Mc, Donald.

Mortgage Broker Scarborough - An Overview

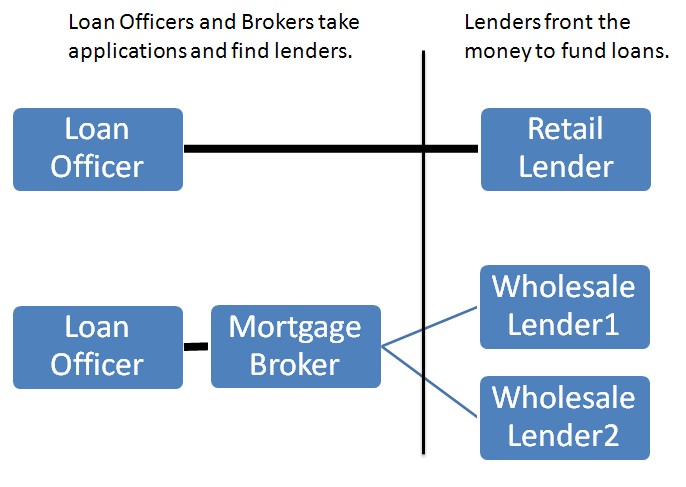

They do this by comparing mortgage items provided by a range of loan providers. A home loan broker serves as the quarterback for your funding, passing the sphere between you, the borrower, and also the loan provider. To be clear, mortgage brokers do a lot more than aid you obtain an easy home mortgage on your house.

When you go to the bank, the financial institution can only supply you the services and products it has readily available. A bank isn't most likely to tell you to drop the street to its rival who uses a mortgage item better fit to your needs. Unlike a bank, a mortgage broker frequently has partnerships with (often some loan providers that do not directly take care of the general public), making his possibilities that better of finding a loan provider with the most effective mortgage for you.

The 20-Second Trick For Scarborough Mortgage Broker

If you've currently made a deal on a building and also it's been accepted, your broker will certainly submit your application as an online deal. As soon as the broker has a home loan commitment back from the lender, he'll review any problems that need to be met (an assessment, proof of income, evidence of down settlement, etc). mortgage broker.

Top Guidelines Of Scarborough Mortgage Broker

As soon as all the loan provider problems have been satisfied, your broker ought to make certain legal guidelines are sent to your legal representative. Your broker ought to remain to sign in Get More Info on you throughout the process to make certain everything goes efficiently. This, in short, is just how a mortgage application works. Why use a find here home mortgage broker You may be questioning why you need to make use of a mortgage broker.Your broker needs to be well-versed in the mortgage products of all these lending institutions. This implies you're most likely to locate the best mortgage item that suits your requirements. If you're a specific with broken credit scores or you're getting a residential or commercial property that remains in less than outstanding condition, this is where a broker can be worth their king's ransom.

Things about Mortgage Broker Scarborough

Make sure to ask your broker the amount of lending institutions he deals with, as some brokers have accessibility to even more loan providers than others and also may do a higher quantity of organization than others, which indicates you'll likely get a much better price. This was a summary of dealing with a home mortgage broker (mortgage broker in Scarborough).

The Only Guide for Mortgage Broker Scarborough

85%Marketed Price (p. a.)2. 21%Comparison Rate (p. a.) Base requirements of: a $400,000 lending amount, variable, taken care of, principal and also interest (P&I) mortgage with an LVR (loan-to-value) proportion of at the very least 80%. The 'Contrast House Loans' table enables for computations to made on variables as chosen and also input by the customer.The choice to making use of a home mortgage broker is for individuals to do it themselves, which is occasionally described as going 'straight'. A 2018 ASIC survey of consumers who had actually secured a lending in the previous year reported that 56% went direct with a lender while 44% experienced a mortgage broker.

Report this wiki page